Sustainability is (not) a business

Welcome to "nouveau monde", sort of a "nouveau genre" newsletter to better understand how to make the world better through the lens of retail. This is #11!

This week in “nouveau monde”, we’ll talk about food waste. And also share the significant importance that ESG took at many levels on business... and finance.

Enjoy, subscribe, share! :-)

Facing a problem much bigger than transportation : food waste

by Anthony

Among the challenges we face regarding climate change, food waste is in the top 3 : more than 30% of all food produced is wasted worldwide, this is huge and completely incredible, knowing that in the same time, more than 10% of the population is undernourished.

This inevitable fact means that we produce way too much food regarding to our needs, or at least that food products are in equally distributed.

To put things in perspective, the Project Drawdown made estimates of the main challenges and what solutions we can develop to get to our carbon emissions goals. And tackling the food waste problem has the same potential as working on the whole transportation system including aviation, road and ocean transportation !

That's about 90 Gigatons of CO2 that can be put out of the atmosphere until 2050 !To face that problem, let's have a look at the retail part ! At its end, a danish startup well known in Europe tries to tackle the waste at the point of sale by organizing and digitilizing the distribution of near to end of date products. Too Good To Go is doing well in Europe and just raised $31 to address the US market. In fact, they have already launched on small areas of the Est coast but this investment will enable them to go West !

On the same area, a French startup, Smartway, tries to help retailers avoid food waste with four integrated products : SmartDetection to detect near out of date products, SmartDecision to help the retailer choses what do do with the product : lower its price point, or donate it for instance, SmartDiscount does the labeling process to make the discount visible and SmartDonation that makes the donation process and enable the products to get to the right place.

All these micro processes enable retailers to avoid food waste while preserving their margins.

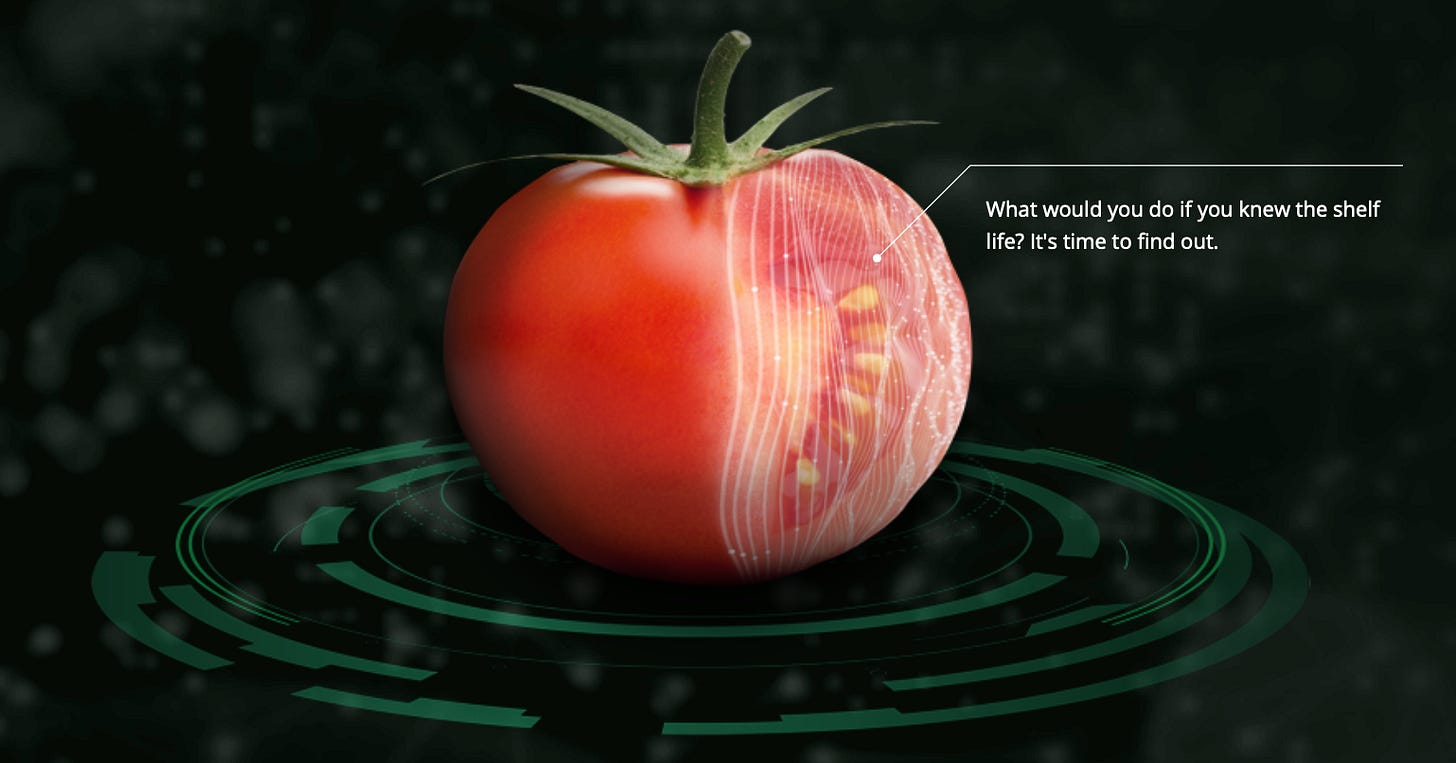

If we go upstream on the logistic chain and try to avoid waste before they arrive to your basket, OneThird might be a good startup to take a look at.

They developed a tool that enable people to determine the shelf life of living products without having to manipulate the fruits or vegetables, making the process twice faster.

Here is a short video of what they propose.

This is key to better sale products while on the shelves but also on the whole supply chain. It has a huge potential of reducing waste !

As always, there is no one single solution to face a problem and food waste might be a complex problem to solve and at the same time the one with the highest potential to reduce our emissions.

Let's be creative and try and address it quick !

Big Finance, Private Equity, Venture Capital, Corporations, all about the greenz attitude

by Phil

The European Parliament and Council reached a provisional agreement enshrining in law the objective of reducing greenhouse-gas emissions by 55% by 2030 and reaching net-zero emissions by 2050. And the European Union published its long-awaited “sustainable finance taxonomy” – a move that could become a global standard for green investment and transform capital markets.

“In the last half-decade, public, corporate, and investor awareness of environmental, social, and governance (ESG) risks has risen sharply. ESG investments expanded exponentially during the pandemic, and are now one of the world’s fastest-growing asset classes – a trend that is set to continue.”, say Kalin Anev Janse and Anu Bradford in the Project syndicate.

Ok, we’re talking about bonds here, and some means to make some money around.

“Consideration of ESG in an investment process requires an industry-specific approach, applied consistently. For example, investing in a retailer requires evaluating the risk exposure to such factors as the company’s data security practices and the environmental impact of the products it sells versus an investment in real estate, which would require evaluation of such factors as energy and water management of its buildings“.

Retailers, be careful on what you put on the shelf, analysts are checking on you…

Now it’s time for Private Equity to consider ESG criteria being part of the game.

“Integrating environmental, social, and governance (ESG) considerations into private equity investment strategies has increasingly become “table stakes” as a condition for accessing capital—and is further magnified by COVID-19.”

What about investing in a startup following ESG mandate, while large corporations all around the world have decisively adopted ESG issues as part of their corporate agenda ? Publicly-traded companies make significant investments in the field, with expectations being for them to rise even more in the near future. And so startups are also catching up on the trend, with more than 60% already implementing ESG policies in their organizational structure. On top of that, more than 50% of the start-ups that have not yet made ESG investments plan to do it as soon as possible.

Deloitte shared those perspectives there.

You’re a business angel. How do you screen startups? Why? Let’s see some pieces of information here.

“There are three different policy areas that ESG investing focuses on.

Environmental Issues: ESG investing attempts to tackle environmental issues that deal with water, air, land, ecosystems, and human health. A huge focus is put on combating climate change, sustainable energy, and preventing pollution. The ways in which companies approach this category depend on the nature of the business itself. For example, a manufacturing company would invest in waste disposal and energy efficiency.

Social Issues: Here, we have problems related to inclusion, diversity, working conditions, and health measures at the workplace. ESG investing improves staff productivity, as well as brand awareness and loyalty on the customer side. On top of that, it generates a lot of positive PR.

Governance Issues: Nowadays, company behavior and policies are under more scrutiny than ever, thanks to globalization and social media. The ESG mindset puts a focus on topics like board accountability and diversity, protecting shareholders, and reporting and disclosing information.

In order to be successful, each modern start-up needs to implement ESG-conscious policies and invest in them as much as possible. The benefits of such a mindset are too valuable to ignore, such as increased investments, employer branding & talent acquisition, risk mitigation, reputation boost and effective unique selling proposition for a competitive edge.”

To all the serious startup entrepreneurs in the world, you thought you had to consider diversity, on the top of building a product, recruiting, selling, fundraising, etc. Now, you must add some slides and spreadsheet to your business plan to demonstrate your ESG rate.

Finally, considering the consumer side, where are you spending your money? Who are you buying your grocery stores from?

Quick Hits

Covid19 forced working habits switch to a more sustainable approach but I know it’s hard to change. So I’m pretty sure that most of you miss the old good smell and noise and atmosphere of a busy working place, your office, whatever. So try this website ands let us know how you feel then. Kisses, Phil

Click here

Bonus track

From Anthony, with love.